DOGE Price Prediction: $0.21 Target in Sight as ETF Hype Builds

#DOGE

- ETF Catalyst: Bitwise's filing could accelerate institutional adoption

- Technical Setup: MACD crossover and Bollinger squeeze suggest breakout potential

- Risk Factors: Regulatory delays may cap gains below $0.186 MA

DOGE Price Prediction

DOGE Technical Analysis: Key Indicators to Watch

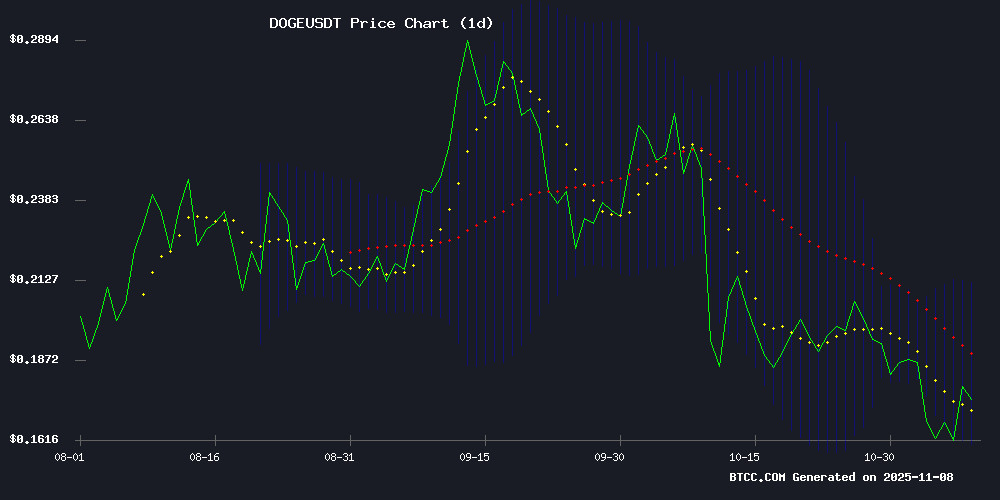

According to BTCC financial analyst Michael, DOGE is currently trading at $0.1751, below its 20-day moving average (MA) of $0.186038. The MACD indicator shows a slight bullish crossover with a reading of 0.009392 (MACD line) vs. 0.008756 (signal line), suggesting potential upward momentum. Bollinger Bands indicate the price is NEAR the lower band ($0.160167), which could signal a buying opportunity if support holds.

Market Sentiment Heats Up as Bitwise Files for First U.S. Spot Dogecoin ETF

BTCC analyst Michael notes that the ETF filing news has sparked a bullish sentiment, with price targets ranging up to $0.21 in the short term. Regulatory progress could drive further gains, though Michael cautions that technical resistance at the 20-day MA ($0.186) must be broken for sustained upside.

Factors Influencing DOGE’s Price

Bitwise Files for First U.S. Spot Dogecoin ETF, DOGE Price Surges

Bitwise Asset Management has taken a bold step toward mainstreaming meme coins with its filing for a spot Dogecoin ETF. The SEC submission, now in a 20-day review window after Bitwise removed its delaying amendment, could launch by mid-November under the ticker BWOW on NYSE Arca. Coinbase Custody will serve as the asset custodian, marking a watershed moment for institutional acceptance of DOGE.

Dogecoin rallied 10% to $0.17 on the news, shaking off recent crypto market doldrums. Glassnode data reveals a critical resistance cluster at $0.20, where 11.12 billion DOGE changed hands. Technical indicators show building bullish momentum, with analysts eyeing $0.25 as the next target should DOGE breach the $0.20 ceiling.

DOGE Price Targets $0.21 as Spot Dogecoin ETF Moves Closer to SEC Approval

Dogecoin's price surged nearly 10% in 24 hours amid growing optimism around a potential spot ETF approval. The meme coin now trades at $0.1811 with $3.43 billion in daily volume, as technical indicators suggest bullish momentum could push prices toward $0.21.

Bitwise Asset Management's SEC filing triggers a 20-day countdown for automatic ETF approval unless regulators intervene. This institutional milestone coincides with DOGE's Bollinger Bands showing oversold conditions and a MACD crossover signaling recovery potential.

Market capitalization stands firm at $27.48 billion, reinforcing DOGE's position among top cryptocurrencies. The ETF prospect has reignited retail interest, though weekly performance remains 3.28% negative due to broader market volatility.

Bitwise Advances Dogecoin ETF Plans, Potential Approval Within Weeks

Bitwise Asset Management has taken a decisive step toward launching the first major institutional Dogecoin ETF. The firm submitted a modified application to the SEC, withdrawing delaying tactics that could accelerate regulatory approval. Market participants now await potential SEC clearance within a 20-day window.

Dogecoin surged 13% following the announcement, demonstrating investor enthusiasm for regulated exposure to the meme-inspired cryptocurrency. While smaller firms like Rex Shares previously entered this space, Bitwise's reputation for operational rigor lends credibility to the nascent market for DOGE investment vehicles.

The crypto community watches closely as institutional adoption milestones approach. A successful Bitwise launch would mark another inflection point for digital assets, following Bitcoin and Ethereum ETF approvals earlier this year.

Dogecoin's $5.76 Elliott Wave Target Sparks Debate Amid Market Uncertainty

Dogecoin's recent AI-driven Elliott Wave projection of a $5.76 price target has divided analysts. The meme cryptocurrency, currently trading near $0.16, would require a 36x surge to meet this ambitious goal—a move that would place its market capitalization near Ethereum's $840 billion threshold. Such growth appears improbable given DOGE's unlimited supply of 146 billion coins.

The Elliott Wave theory suggests Dogecoin may be entering wave 3, typically the strongest phase in bull markets. Fibonacci extensions indicate potential targets reaching $48.55 under ideal conditions. Yet market realities—including struggling credibility and directional uncertainty—cast doubt on these technical optimistic scenarios.

Bitwise Accelerates Dogecoin ETF Launch Amid Regulatory Opportunism

Bitwise Asset Management is executing a regulatory speed-run with its Dogecoin ETF filing, leveraging an 8(a) provision to bypass traditional SEC approval delays. The fund will track the CF Dogecoin-Dollar benchmark and could launch within 20 days of its automatically effective S-1 amendment.

The move follows the SEC's June rejection of Bitwise's initial Dogecoin ETF application and Grayscale's similar proposal. Current market conditions—including a U.S. government shutdown that has reduced SEC oversight capacity—have created an opportunistic window for crypto ETF approvals. The Commission recently cleared multiple crypto ETF listing standards while operating with reduced staff.

Bitwise's strategic timing coincides with its recent Solana-focused product launches, demonstrating the firm's aggressive positioning in alternative crypto ETFs. Market observers note the SEC's apparent shift toward procedural efficiency, with some speculating that reduced regulatory scrutiny during the shutdown has created a de facto fast-track for crypto products.

Dogecoin Price Prediction: Can DOGE Hit $4 After ETF Approval?

Bitwise Asset Management's filing for a spot Dogecoin ETF has sparked market optimism, potentially marking the first meme-coin ETF. Analysts suggest SEC approval could come within 20 days, following recent in-kind redemption amendments. Such a move would open doors for institutional exposure to DOGE, historically dominated by retail investors.

Dogecoin shows resilience with a 1.85% gain over 24 hours, trading at $0.1669 despite a 7.68% drop in trading volume. The token's $25.17 billion market capitalization reflects sustained interest from both traders and long-term holders. Technical indicators suggest a bearish-to-bullish reversal pattern emerging.

Market observers believe a Dogecoin ETF could catalyze the next AltSeason, where altcoins typically outperform Bitcoin. Price targets of $4 are gaining traction among analysts, fueled by growing institutional interest and improving market sentiment. The potential ETF approval represents a watershed moment for meme coins seeking mainstream financial legitimacy.

How High Will DOGE Price Go?

Michael projects a near-term target of $0.21 (Bollinger upper band) if ETF optimism persists, with these key levels to watch:

| Indicator | Value | Implication |

|---|---|---|

| 20-day MA | $0.186 | Key resistance |

| MACD | 0.000636 (histogram) | Bullish momentum building |

| Bollinger Upper | $0.2119 | Primary target |

Analysis based on current technicals and news flow; volatility expected around SEC decisions.